![]()

|

Retail Market Monitor |

|

|||||||

|

|

||||||||

|

|

|||||||

|

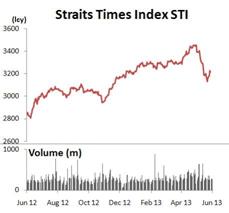

Price

Chart

Source: Bloomberg |

||||||||

|

Key Indices |

||||||||

|

|

Price |

Chg (%) |

YTD (%) |

|||||

|

DJIA |

15,112.19 |

(1.3) |

15.3 |

|||||

|

S&P 500 |

1,628.93 |

(1.4) |

14.2 |

|||||

|

FTSE 100 |

6,348.82 |

(0.4) |

7.6 |

|||||

|

FSSTI |

3,213.79 |

(0.5) |

1.5

|

|||||

|

HSI |

20,986.89 |

(1.1) |

(7.4) |

|||||

|

CSI 300 |

2,400.77 |

(0.7) |

(4.8) |

|||||

|

Nikkei 225 |

13,245.22 |

1.8

|

27.4 |

|||||

|

KLCI |

1,772.88 |

(0.1) |

5.0 |

|||||

|

|

|

|

|

|||||

|

Top Volume |

||||||||

|

Stock |

Price (S$) |

Chg (%) |

Volume (‘000) |

|||||

|

Singapore Telecom Ltd |

3.690 |

(2.1) |

29,666 |

|||||

|

Golden Agri-Resources Ltd |

0.570 |

(0.9) |

27,926 |

|||||

|

Noble Group Ltd |

1.025 |

0.0

|

20,902 |

|||||

|

Thai Beverage Pcl |

0.615 |

0.8

|

19,709 |

|||||

|

Global Logistic Properties Ltd |

2.690 |

(1.1) |

19,102 |

|||||

|

|

|

|

|

|||||

|

Top Gainers |

||||||||

|

Stock |

Price (S$) |

Chg (%) |

Vol (‘000) |

|||||

|

Silverlake Axis Ltd |

0.770 |

5.5

|

3,079 |

|||||

|

Raffles Medical Group Ltd |

3.040 |

3.4

|

195 |

|||||

|

Osim International Ltd |

2.020 |

3.1

|

1,031 |

|||||

|

ARA Asset Management |

1.850 |

2.8

|

1,331 |

|||||

|

Haw Par Corp Ltd |

7.320 |

2.4

|

56 |

|||||

|

|

|

|

|

|||||

|

Top Losers |

||||||||

|

Stock |

Price (S$) |

Chg (%) |

Vol (‘000) |

|||||

|

Del Monte Pacific Ltd |

0.800 |

(3.6) |

48 |

|||||

|

Petra Foods Ltd |

3.650 |

(2.7) |

211 |

|||||

|

Hongkong Land Holdings Ltd |

6.840 |

(2.6) |

1,604 |

|||||

|

Singapore Telecom Ltd |

3.690 |

(2.1) |

29,666 |

|||||

|

Singapore Airlines Ltd |

10.200 |

(1.9) |

1,595 |

|||||

|

Money Talk |

|

|||||||

|

|

||||||||

|

|

NOT RATED |

|||||||

|

MEGCIF5

invests Rmb271.25m for a 35% stake in Hengyang Holding Pte Ltd Valuation ·

Discount

to peers’. Investment Highlights ·

Hengyang

Petrochemical Logistics (Hengyang) transports and stores

liquid petrochemical products such as phenol, fuel oil, acetic acid and

ethylene for blue-chip customers, including BP, BASF, CNOOC, Shell and

Sinopec. The group operates in the Yangtze River Delta and has operational

facilities in Deqiao, Jiangyin. ·

New

facilities to boost storage capacity. The group is

currently developing new facilities in ·

Strategic

investor MEGCIF5 took up a 35% stake in Hengyang Holding Pte Ltd (HHPL). Macquarie

Everbright Greater China Infrastructure Fund Investments 5 Ltd (MEGCIF5) has

agreed to invest Rmb271.25m for a 35% stake in HHPL, with ·

MEGCIF5

is a global infrastructure fund managed by ·

We

view the transaction as positive as it may reflect the

true market value of |

|

|

||||||

|

Share

Price |

S$0.33 |

|||||||

|

Target

Price |

n.a. |

|||||||

|

Upside |

n.a. |

|||||||

|

Company Description |

||||||||

|

Hengyang Petrochemical Logistics is a petrochemical

logistics services provider. The company mainly stores and transports liquid

petrochemical products. It also provides land transportation services. |

||||||||

|

GICS sector |

Energy |

|||||||

|

Bloomberg ticker: |

HYNG SP |

|||||||

|

Shares issued (m): |

203.5 |

|||||||

|

Market cap (S$m): |

67.1 |

|||||||

|

Market cap (US$m): |

53.3 |

|||||||

|

3-mth avg

t'over (US$m): |

0.0 |

|||||||

|

|

|

|||||||

|

Price

Chart

Analyst Brandon Ng, CFA +65 6590 6615 brandonng@uobkayhian.com |

||||||||

|

Key Financials |

|

|||||||

|

Year

to 31 Dec (Rmbm) |

2010 |

2011 |

2012 |

1Q12 |

1Q13 |

|||

|

Net Turnover |

70.0 |

89.0 |

110.4 |

31.6 |

25.9 |

|||

|

EBITDA |

30.8 |

36.4 |

47.6 |

14.0 |

10.5 |

|||

|

EBIT |

25.1 |

26.6 |

25.2 |

8.3 |

5.1 |

|||

|

Net profit |

16.8 |

16.2 |

5.4 |

3.1 |

1.4 |

|||

|

EPS (fen) |

11.75 |

10.55 |

2.76 |

1.75 |

0.71 |

|||

|

PE (x) |

13.7 |

15.2 |

58.2 |

- |

- |

|||

|

P/B (x) |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

|||

|

Dividend Yield (%) |

0.0 |

0.0 |

0.0 |

- |

- |

|||

|

PATMI Margin (%) |

23.9 |

18.2 |

4.9 |

9.7 |

5.4 |

|||

|

Net Debt to Equity (%) |

29.9 |

16.9 |

31.9 |

8.5 |

64.2 |

|||

|

Interest cover (x) |

2.4 |

1.3 |

2.2 |

- |

- |

|||

|

ROE (%) |

6.3 |

5.3 |

1.5 |

- |

- |

|||

|

Source:

Bloomberg, UOB Kay Hian |

||||||||

|

Retail Market Monitor |

|

|||||||

|

|

||||||||

|

Traders’ Corner |

|

|||||||

|

|

Straits Times Index (FSSTI Index) – 5.4% potential downside Last level: 3,213 Resistance: 3,235 Support: 3,060 Downward bias with a target level of 3,060-3,080 (a 50%R zone). The FSSTI has hit our rebound

target of 3,230 and appears to form an

interim tweezer top and is trading below its 150-day moving average. A break

below its 200-day moving average may suggest more selling pressure, perhaps

towards its immediate rising trendline. Its 14-day RSI indicator appears to

turn down below a reading of 45 and its weekly MACD indicator is showing no

signs of reversal. Watch to see whether its daily MACD indicator could hook

down instead. The next support level could be near 2,950. |

|||||||

|

|

Genting Singapore (GENS SP,

G13) – Technical SELL with +7.5%

potential return Last price: S$1.395 Resistance: S$1.45 Support: S$1.29 SELL with a target price of S$1.29 with tight stops placed above

S$1.435. The stock has failed to move above its mid Bollinger band and its

50- and 200-day moving averages look poised to form a dead cross. Its

Stochastics indicator looks poised to form a bearish crossover. Watch to see

whether its MACD indicator could hook down instead. Our institutional research has a fundamental SELL with a target price

of S$1.17. |

|||||||

|

|

City Developments (CIT SP,

C09) - Take profit from previous technical BUY Last price: S$10.50 Resistance: S$10.68 Support: S$9.68 The stock was featured as a technical buy on 14 Jun 13 when it opened

at S$9.82 and did not stop out below S$9.65. The stock has since returned

6.9% on closing prices. Some profits could be taken off the table as the stock

has currently exceeded our buy target price of S$10.30. Watch to see if the

stock could be well supported near its 200-day moving average. Our institutional research has a fundamental HOLD with a target price

of S$12.19. |

|||||||

|

Source: Nextview |

Jeffrey Tan +65 6590 6629 jeffreytan@uobkayhian.com |

|||||||

|

Retail Market Monitor |

|

|

|

|

|

Corporate News |

|

|

SingTel: In tie-up

with online storefront firm. SingTel is throwing its weight behind online shopping through

its partnership with Canadian online retail storefront firm, Shopify.

Yesterday, the telco announced the launch of Shopify here and in Tat Hong: Sets up

S$500m MTN programme. Tat Hong Holdings has established a S$500m multi-currency medium

term note (MTN) programme. Net proceeds will be used for general corporate

purposes, including the refinancing of borrowings, capital expenditure and

general working capital. Tat Hong was in the news recently for entering into

heads of agreement with Intraco and Genting MLT: Buys Korean

warehouse.

Mapletree Logistics Trust (MLT) has acquired its eighth piece of property in |

|

|

Retail Market Monitor |

|

|

|

|

|

From the Regional Morning Notes |

|

|

(SIA

SP/HOLD/S$10.20/Target: S$11.50) FY13 PE(x):

30.4 FY14F PE(x):

37.0 Weaker-than-expected

2MFY14 traffic numbers, warning on yields and concern over SIA’s aircraft

orders lead us to downgrade SIA to HOLD. Yields are under pressure and if loads don’t

improve in June, losses are likely. Along with the May operating stats, SIA

mentioned that yields are expected to remain under pressure as efforts are

made to boost loads in the current operating environment. June is a peak period

in 1QFY and if loads are below 80.5%, the odds of the parent airline business

swinging into a loss are heightened. Silk Air

fares no better with a ytd 7.4% decline in load factor. In 1QFY13, Silk Air

contributed 25% of group operating profit. Given, the steep decline in loads,

no doubt due to competition from low-cost carriers (LCC), Silk Air’s yields

and profits are also likely to remain weak in 1QFY14. Market

spooked by huge aircraft orders. As at end-FY12, SIA had capital commitments

of S$7.5b. Recent orders along with associated engine orders could place this

commitment at an estimated S$55b over the next 10-12 years. Total commitment

now stands at 5x book value 4.6x market cap. While SIA has several options

such as sale and leaseback of existing aircraft, we reckon it will fund about

20-25% of its capex requirements. SIA has generated an average of S$2.2b in

operating cash flow over the past years and thus internal cash flow could

fund about 50% of capex requirements on a straight line basis. We estimate

that SIA would thus require external funding in the range of S$5b-8b to

fulfill its capex commitments. Competition

from Middle Eastern hubs. According to Amadeus, Air Traffic Trend

Intelligence Solution, 15% of all pax traffic between Asia Pacific and Europe

transit at Downgrade

from BUY to HOLD, with a lower target price of S$11.50 (S$13.30 prev). We now value SIA at

0.75x forward book value (0.9x previously) on the back of higher capex

commitments and weaker-than expected pax traffic growth. We cut our FY14

earnings estimates by 34% factoring in lower pax yields and adjusting our

passenger and cargo traffic assumptions. |

|

|

Retail Market Monitor |

|

|

|

|

|

Important Disclosure |

|

|

We

have based this document on information obtained from sources we believe to

be reliable, but we do not make any representation or warranty nor accept any

responsibility or liability as to its accuracy, completeness or correctness.

Expressions of opinion contained herein are those of UOB Kay Hian Research

Pte Ltd only and are subject to change without notice. Any recommendation

contained in this document does not have regard to the specific investment

objectives, financial situation and the particular needs of any specific

addressee. This document is for the information of the addressee only and is

not to be taken as substitution for the exercise of judgement by the

addressee. This document is not and should not be construed as an offer or a

solicitation of an offer to purchase or subscribe or sell any securities. UOB

Kay Hian and its affiliates, their Directors, officers and/or employees may

own or have positions in any securities mentioned herein or any securities

related thereto and may from time to time add to or dispose of any such

securities. UOB Kay Hian and its affiliates may act as market maker or have

assumed an underwriting position in the securities of companies discussed

herein (or investments related thereto) and may sell them to or buy them from

customers on a principal basis and may also perform or seek to perform investment

banking or underwriting services for or relating to those companies. UOB

Kay Hian (U.K.) Limited, a UOB Kay Hian subsidiary which distributes UOB Kay

Hian research for only institutional clients, is an authorised person in the

meaning of the Financial Services and Markets Act 2000 and is regulated by

Financial Services Authority (FSA). In

the http://research.uobkayhian.com MCI

(P) 122/03/2013 RCB

Regn. No. 198700235E |

|