|

Retail Market Monitor |

|

|||||||

|

|

||||||||

|

|

|||||||

|

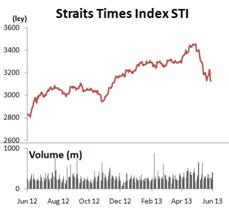

Price

Chart

Source: Bloomberg |

||||||||

|

Key Indices |

||||||||

|

|

Price |

Chg (%) |

YTD (%) |

|||||

|

DJIA |

14,799.40 |

0.3

|

12.9 |

|||||

|

S&P 500 |

1,592.43 |

0.3

|

11.7 |

|||||

|

FTSE 100 |

6,116.17 |

(0.7) |

3.7 |

|||||

|

FSSTI |

3,124.45 |

(0.3) |

(1.3) |

|||||

|

HSI |

20,263.31 |

(0.6) |

(10.6) |

|||||

|

CSI 300 |

2,317.39 |

(0.2) |

(8.1) |

|||||

|

Nikkei 225 |

13,230.13 |

1.7

|

27.3 |

|||||

|

KLCI |

1,755.85 |

(0.4) |

4.0 |

|||||

|

|

|

|

|

|||||

|

Top Volume |

||||||||

|

Stock |

Price (S$) |

Chg (%) |

Volume (‘000) |

|||||

|

0.550 |

(0.9) |

62,727 |

||||||

|

Wilmar International |

3.250 |

0.3

|

44,163 |

|||||

|

Capitaland |

3.050 |

(2.2) |

42,986 |

|||||

|

Keppel Reit |

1.330 |

(0.4) |

35,726 |

|||||

|

Thai Beverage Pcl |

0.605 |

0.8

|

32,921 |

|||||

|

|

|

|

|

|||||

|

Top Gainers |

||||||||

|

Stock |

Price (S$) |

Chg (%) |

Vol (‘000) |

|||||

|

3.300 |

6.1

|

484 |

||||||

|

Oxley Holdings |

0.370 |

5.7

|

1,558 |

|||||

|

SMRT Corp |

1.525 |

3.7

|

2,909 |

|||||

|

Parkwaylife Real Estate |

2.480 |

2.9

|

826 |

|||||

|

Yoma Strategic Hldgs |

0.950 |

2.7

|

18,902 |

|||||

|

|

|

|

|

|||||

|

Top Losers |

||||||||

|

Stock |

Price (S$) |

Chg (%) |

Vol (‘000) |

|||||

|

1.050 |

(5.4) |

7,863 |

||||||

|

Mapletree Logistics Trust |

1.070 |

(4.5) |

8,720 |

|||||

|

|

3.450 |

(4.2) |

307 |

|||||

|

UOB-Kay Hian Holdings |

1.610 |

(3.9) |

741 |

|||||

|

Del Monte Pacific |

0.770 |

(3.8) |

260 |

|||||

|

Weekly Watch |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Oil service: Ezion, |

Price

Charts

Source: Bloomberg Analysts +65 6535 6868 research@uobkayhian.com |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

-

BUY on dips as oil service stocks are

early-recovery cyclicals Highlights ·

An interest rate turn points to a global economic

recovery outlook. The oil service sector has been a consistent early-recovery

cycle play and we recommend buying on dips. ·

We expect greater earnings ramp-up for Ezion over 2013-15 with

net profit trebling as more projects commence operation. ·

Kreuz’s management plans to charter in one additional vessel to add capacity.

·

Last Week ·

The Federal Reserve Chairman outlined the QE schedule by commenting that tapering could

begin in late-13 with the programme possibly ending by mid-14. Forecasts

were revised on the back of an improving employment outlook and steady

inflation. Looking Ahead ·

Small-caps lag large-caps in the current market correction; BUY on

dips. The oil service

sector is still the second-best performing sector ytd (+9.9%) as it is

recovering from low valuations. Today, it still trades at a 37% discount to

its long-term P/B mean of 1.78x. We advocate buying on dips as the sector has

been a consistent early-recovery cyclical play. Our top picks include Ezion,

Kreuz and Nam Cheong. ·

The silver lining in the cloud. An interest rate turn points to a global economic

recovery outlook. We expect investors to switch from defensives to cyclicals.

For the oil service sector, we prefer a bottom-up strategy that favours

companies in an aggressive business expansion phase leading to EPS

improvement. ·

Source: Bloomberg, Government websites |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Weekly Watch |

|

|

|

|

||

|

Stocks Alert |

|

|

|

|

Ezion Holdings (EZI SP, 5ME) – Operating earnings to treble over 2013-15 (BUY/Target

S$2.60/S$2.14) Ezion’s net profit more than doubled in 1Q13 due

to a one-off gain. Excluding this, results were still ahead of expectations

and we expect higher earnings in the remaining quarters of the year as more

liftboats and service rigs commence operation. Over the next three years we

project operating profit to treble. Following its recent breakthroughs in Technically

the stock could retrace towards S$2.08/1.95

should it fail to recapture its previous high of around S$2.45. |

|

|

|

Kreuz Holdings (KRZ SP, 5RK) – New capacity to bridge 2014 growth gap (BUY/Target

S$0.88/S$0.675) We met up with Kreuz’s management recently and they touched on plans

to ease their current capacity constraint. In 2014, they plan to charter one

additional vessel on a long-term contract. This will allow Kreuz to bid for

additional contracts and we estimate this could lift earnings by 5-15%. In

our view, Kreuz is likely to clinch higher-than-expected variation orders

this year, which will more than offset lower-than-forecasted contract wins.

Kreuz’s end-1Q13 orderbook stood at US$200m, which will be recognised over

12-18 months. Kreuz also has an option with a Chinese shipyard to build a

second deepwater subsea vessel, which we believe is likely to be exercised.

Continued improvement in Kreuz’s receivables and gearing will drive its share

price re-rating. It has logged in seven straight quarters of positive

operating cash flow. We have a BUY recommendation and target price of 88 S

cents, pegged to a 2014F PE of 8x. Technically, the stock currently has immediate support levels

near S$0.64/S$0.58 and the stock is resisted near S$0.79. |

|

|

|

Nam Cheong (NCL SP,

N4E) – Strong visibility from a record net orderbook (BUY/Target

S$0.34/S$0.265) Nam Cheong’s reported 1Q13 profit was in line with our forecast. A key

positive was the sale of five vessels, bringing net orderbook to a record

RM1.3b. This provides strong earnings visibility for the next three years.

According to management, there have also been more enquiries on

built-to-order vessels, which is a sign of an industry-wide uplift in

activity. Management disclosed more details about the shipbuilding programme

for 2014, which we view as a well-balanced mix of different vessel types. We

maintain BUY and target price of S$0.34, based on 9.7x 2014F PE. Technically, the stock has been supported near S$0.24 and it

has a potential resistance near S$0.31. |

|

|

Source: Nextview |

|

|