30 June 2025

HKEX’s Enhancement of Settlement Arrangement and Trading Matters for Eligible Multi-Currency Securities (effective from 30 June 2025)

Hong Kong Exchanges and Clearing Limited (HKEX) will enhance the settlement arrangement for Multi-Counter Eligible Securities by introducing the “Single Tranche Multiple Counter” model, effective from 30 June 2025. Please take note of the following changes that will come into effect from this date:

Key changes:

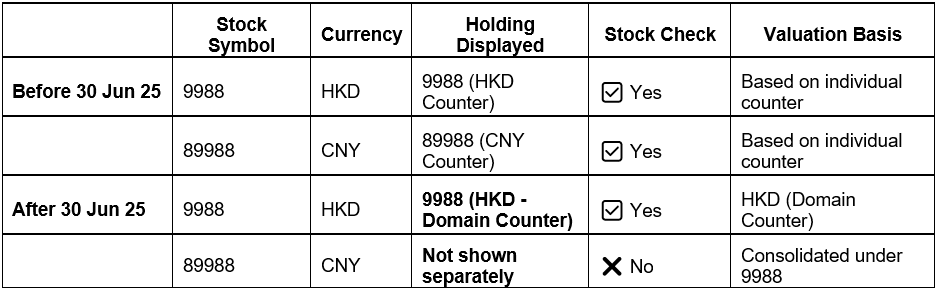

- Holdings: For clients currently holding Multi-Counter Eligible Securities in a Non-Domain counter (CNY/USD), please note that these holdings will be converted to HKD Domain Counter.

- Contract Note: Will display the Domain counter stock details and respectivetraded currency (HKD/CNY/USD).

- Month-End Statement: Valuations will reflect holdings based on the Domain Counter in HKD

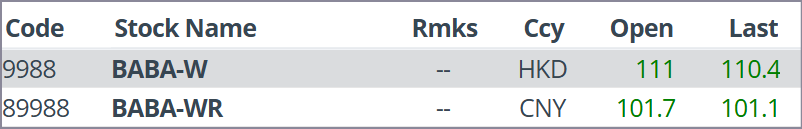

- Trading: Clients to select their desired stock symbols from UTRADE/AdvisorT platform. e.g. 9988 for HKD-denominated trade and 89988 for CNY-denominated trade

Important note for trading:

- Stock holding checks will be applied only in the domain currency (e.g., 9988 Alibaba in HKD).

- No stock holding checks for Non-HKD currency counters (e.g., 89988 Alibaba in CNY).

- Intraday trading - clients who purchase CNY/USD denominated counter will not be able to sell HKD denominated counter on the same day due to holdings check. However, the counter can be sold in either currency from T+1 onwards.

- Clients to exercise caution when selling Multi-Counter Eligible Securities.

For illustration purpose

For more information, please refer to the following links from HKSE website:

Enhancement of Settlement Arrangement for Multi-counter Eligible Securities

Full list of Multi-Counter Eligible Securities

https://www.hkex.com.hk/-/media/HKEX-Market/Services/Clearing/Securities/What_s-New/Single-Tranche-Multiple-Counter-Settlement-Model/Full-list-of-Multicounter-Eligible-Securities-for-STMC-Migration-on-28-June-2025.xlsx